It's tax season (again!)

- Rebecca Herbst

- May 22, 2022

- 3 min read

"OMG yay it's tax season!!!!" said no one else but my partner Joe. You're probably already groaning at the sight of this newsletter's subject line. But let me help ease those woes with some guidance. The due date for filing tax returns and making tax payments is April 18, 2022. Joe and I just got ours done yesterday, and while it took me a strong cup of English Breakfast Tea to get going, I was done in a few hours. For those of you that have not started your taxes, you can use any of the following tax software.

H&R Block (easy, not free)

TurboTax (easy, usually not free)

Credit Karma, now CashApp (slightly harder, but free)

Free Fillable Forms (so much harder, free)

By Hand & Mail (WTF, who does that?!)

Others programs (I have not used so I won't say too much): TaxSlayer, Tax Act

Joe and I both used Free Fillable Forms this year, which I only recommend doing if you are committed to reading actual tax instructions from the IRS. To a very small degree, I’m happy that we use this product because it forces us to really understand the tax impact of our financial choices. However, if I'm being truly honest, I wouldn’t feel comfortable going this route without insanely detailed-oriented Joe by my side catching all my errors.

^ Real documentation of Joe doing our taxes. Little Boppy is my nickname. So for those of you calling us crazy for using Free Fillable Forms, I get it. Services like TurboTax are absolutely fine to use (even though they are truly evil, see below*). I would just encourage you to go through your actual tax forms at the end to see how your inputs come out on paper. Else, here are some core reminders as you prepare to file:

The deadline for IRA & HSA contributions for 2021 actually bleeds into the beginning of this year. So you have until April 18, 2022 to contribute to your IRA or HSA for the 2021 tax year.

If you over-contributed to any of your tax-advantage accounts (remember there are federal limits!), don’t worry…you can still fix that by contacting your bank to make the necessary adjustments and avoid any penalties.

If you have any capital losses from previous years, make sure to carry that over, or apply that to any gains you might have had from selling stocks/bonds this past year. Remember, you will not be taxed on capital gains in your tax advantaged accounts (e.g. IRA, 401k, 529, HSA).

Charitable donations of up to $300 made by Dec 31, 2021 are deductible (above and beyond your standard deduction). This is a unique benefit extended from last year due to the CARES ACT.

Most of the tax changes enacted by the COVID-relief bill will expire and no longer apply from 2022 onwards, so make sure to take advantage of them for the 2021 tax year. They include the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and Recovery Rebate Credit and more.

*I shared this last year during tax season and I"ll share it again. If any of you have ever questioned why doing taxes is so damn hard...it’s because the US tax system and the players involved are insanely corrupt. If you’re looking for a good download on our entire messed up system, I recommend this episode from the Patriot Act with Hasan Minhaj!

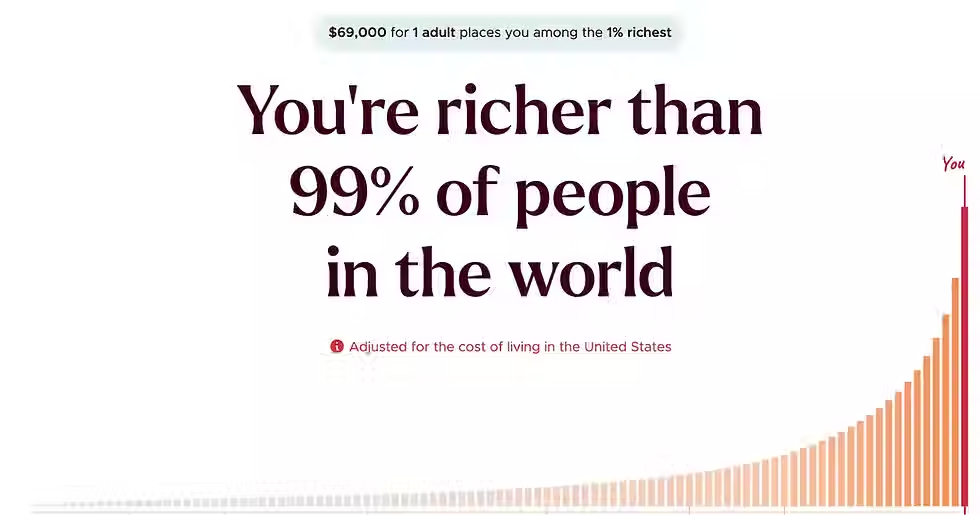

Even though tax time can be frustrating, it's also an opportunity to use them to your advantage as you invest and build wealth. You guys got this!

Boost your Wallet. Wellbeing. World.

Rebecca

I got together with Giving What We Can and Financial Independence Europe to discuss Financial Independence and Effective Giving.

Disclaimer: The information contained in the Yield & Spread website, course materials and all other related content is provided for informational and educational purposes only. It is not intended to substitute for obtaining accounting, tax, or financial advice, and may not be suitable for every individual. Yield & Spread is not a registered investment, legal or tax advisor or a broker/dealer.