The Mega Backdoor Roth

- Rebecca Herbst

- Jul 26, 2021

- 4 min read

Updated: Jan 16, 2023

I've now done a few personal finance presentations for different business groups, specifically focusing on the 401k. Each time I give these presentations, an old headache comes up for me. I’m reminded just how bad our own employers are at teaching us about their very own benefits.

So today I’m prompted to talk about the Mega Backdoor Roth

Which rarely ever gets promoted in the workplace! And well, it SHOULD be.

A Mega Backdoor Roth is a special type of 401k rollover strategy used by people with high incomes to maximize their tax-advantaged investments. This is not to be confused with the Backdoor Roth).

In addition to a pre-tax 401k account and a Roth 401k account, providers sometimes offer a third bucket, an after-tax account. For those that have access to this third bucket, they are often confused by what the difference is between after-tax and Roth. It's the after-tax bucket that enables you to do a Mega Backdoor Roth.

So what is this after-tax contributions bucket and what the heck is a Mega Backdoor Roth?

There are three qualifying factors to be able to do a Mega Backdoor Roth.

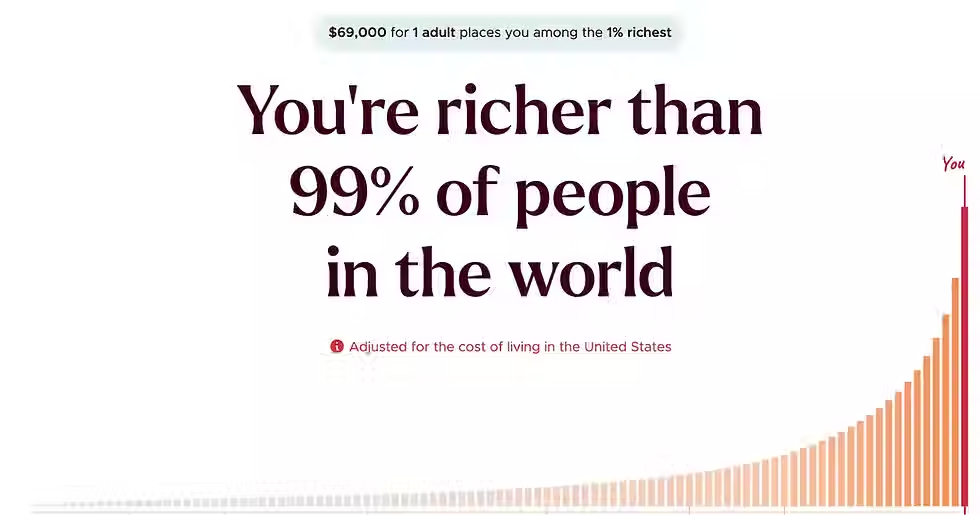

First and foremost, you have enough money leftover after maxing out your 401k ($22,500 for 2023 tax year) and you want to invest more in a tax-advantaged account. This assumes you earn a good income and/or can aggressively save.

You have a 401k plan that allows for “after-tax contributions”. Again this is a separate & additional bucket to a Roth 401k. When you sign into your 401k online platform, this should be readily obvious, but if not reach out to your benefits team. Again, your company may only provide 2 of the 3 buckets (or maybe only one).

Your employer must provide an “in-plan conversion” option OR an “in-service distributions” option. Both of these options allow you to move your contributions from the “after-tax” 401k bucket to one of your Roth accounts. In-plan conversions allow you to move money to your Roth 401k and in-service distributions allow you to move money right to your Roth IRA. Both are great options. Which benefit you have may be less obvious so chances are you may have to reach out to your provider to find out.

If you meet all three conditions above and want to have more long-term, tax-free investment growth, then it’s super smart to make an after tax-contribution and execute on the Mega Backdoor Roth.

How much can I contribute to an after-tax bucket?

The max that you and your employer combined can put into your 401k plan (made up of the three buckets above) is $66,000 ($73,500 if you’re over 50) for the 2023 tax year.

So for example, you max out your regular 401k ($22,500), and your employer provides a match too (let’s say up to $5,000). You are allowed to contribute the leftover amount, up to the $66,000 limit, into your after-tax contribution bucket. What is your leftover amount in this case?

$66,000 (max you and your employer can contribute to a 401k)

- $22,500 (your direct contributions to traditional and/or Roth 401k)

- $5,000 (your company match)

= $38,500 leftover that you can contribute to your “after-tax contributions”

If you're scared you might go over the limit, employers typically have a stop-gap in place to stop you from over-contributing.

How is the after-tax bucket different from a traditional or Roth 401k? This is where the name “after-tax” is confused with “Roth”. Unlike a Roth 401k, this after-tax bucket does not allow for your earnings to grow tax free forever. You will face both income tax and taxes on the account growth (capital gains and taxes on dividends & interest). So this account in and of itself isn’t really any different than a regular brokerage account. HOWEVER, per guideline #3 stated above, if your employer allows for an in-plan conversion or in-service distributions, you can move this money easily and tax free over to a Roth account.

Executing on the Mega Backdoor Roth Once you make your contributions, you want to move the money from the “after-tax” bucket to your Roth bucket immediately. The key here is speed, as you don’t want to accrue earnings in a non-Roth account. Why? Because when you move your money over to a Roth account, any earnings will be taxed. Some employers may have this Mega Backdoor Roth System automated, some may not, in which case you may have to call your 401k provider or go online to do the actual in-plan conversion (to your 401k) or in-service distribution (to your IRA) each paycheck. I recommend asking your HR benefits team what the process is, and if they don’t have the answer, call up your 401k provider. I should also note, there may be a small fee associated with the in-plan conversion or in-service distribution, but it is usually worthwhile. Once you get those funds into a Roth account, your investments will grow tax-free forever!

To summarize it all up in one place, I’ll leave you with the following checklist:

Check to see whether your employer has an “after-tax” contributions bucket

Check to see whether your employer offers in-plan conversions (401k) or in-service distributions (IRA)

Check with your 401k provider/bank if the in-plan conversion or in-service distribution is automated, and what you have to do every paycheck to ensure your money is moved as quickly as possible into your Roth accounts

Determine the additional amount you can contribute to your 401k without exceeding $66,000

Start your contributions!

Watch your money grow tax-free forever!

A final note, don’t be surprised if you reach out to HR and they do not have all the answers on hand. Chances are the person you are asking has no idea what a Mega Backdoor Roth is. Don’t be discouraged, just give your 401k provider (the bank) a call and ask them to walk you through the process.

Boost your Wallet. Wellbeing. World.

Rebecca

Disclaimer: The information contained in the Yield & Spread website, course materials and all other related content is provided for informational and educational purposes only. It is not intended to substitute for obtaining accounting, tax, or financial advice, and may not be suitable for every individual. Yield & Spread is not a registered investment, legal or tax advisor or a broker/dealer.