Student Stories: Taking a gap year

- Rebecca Herbst

- Dec 15, 2022

- 6 min read

Updated: Feb 5, 2023

Welcome back to our Student Stories!

Everyone, meet Maddie! We floated in the same circles while at WeWork, and crossed paths again when she took the Learn to Invest & Build Wealth course. Maddie is bright, animated, and has made some huge strides in her finances over the past 2 years!

I’m excited Maddie is partaking in the student series because she has a story which has threads that I see so often. She is in that sweet spot in her career right now. She has 3.5 years of experience under her belt, but still has tons of runway for future growth. This makes her a super attractive candidate for future employers, but Maddie is toggling with a few ideas. Does she push ahead with her career? Move cities? Take a sabbatical? And all those questions are lined with “what if’s”...

Let’s hear more from her!

Maddie, Introduce Yourself! Hi Everyone! I currently live in NYC, the Nolita Area, right next to the Little Italy sign. I’m 25 years old. I’m a lover of yoga, traveling, cooking delicious food, and gardens (particularly Elizabeth St. Garden!). I’ve been working for a few years in NYC now, and I’m currently at a boutique hotel start-up. Now I can work remotely, whereas my previous job required me to be in an office 4 days a week. This new role has provided me with an increase in pay by 50% and a title promotion with more responsibility! Wow, that all sounds pretty good. What’s got you hung up? I’m questioning my time here in NYC. I feel rent-poor and I’m not sure the cost of living outweighs my desire to stay. I have 4 months left on my lease, and as I near its end, I’ve become more and more interested in exploring all the world has to offer abroad. I’ve begun to take this more and more seriously and have been contemplating a move. If not now, when? I’m employed with a remote job, single, healthy, and curious! What type of move are we talking about? I’m largely open about where to go. I think I could enjoy living in a variety of places! So I’ve more so considered what a move would look like for me. There are a few scenarios I’ve considered.

Go remote with my current job and move abroad. I would be able to keep my income stream while also having the flexibility to try out some new places to visit and/or live. The downfalls are that while I am traveling A. There will not be anyone physically at my company who I can collaborate with in person, whereas in NYC I have this benefit. I worry this would be an isolating experience. B. I worry it may be exhausting bopping from place to place and only having a “temporary home”.

Stay put in NYC and grind until the answers become “clearer”, whatever that means. There’s always more to see, do, and discover in NYC. And deciding when to leave is a difficult decision for me. If I stay, I have a wonderful network of best friends, colleagues, and family in NYC and could also try a new borough in NYC such as somewhere in Brooklyn. Even so, I feel the urge to make a big change in location, experience somewhere new, and take a bit more risk in being alone. I can always come back, right?

Take a gap year, or at least some time off. This option excites me, but having no income terrifies me. In some ways, I know I need to actually experience a “gap year” to prove to myself it can be done, but the math still seems fuzzy. I think I need to build my finances for about 10-12 more months before I can be financially confident that I will properly enjoy this gap time, while also not absolutely blowing through all of my savings. Right now, I am satisfied with my job and the job market is extremely turbulent right now so I don’t feel confident in making a decision like this NOW. But I do know in my heart this is something I ultimately want to do.

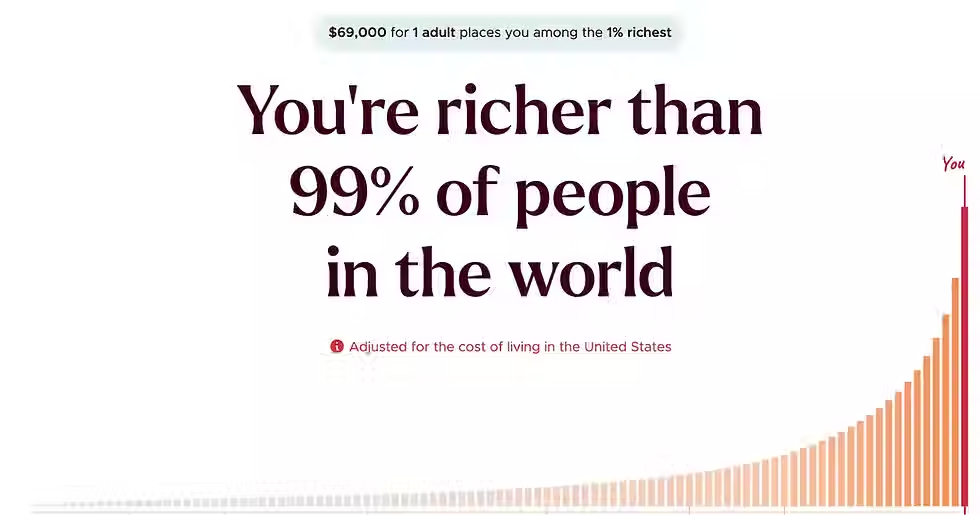

Which option are you leaning towards? For now, I am leaning towards Option 1 – stick with my remote job but leave NYC and travel to places that are within that a similar time zone. This can be Canada, Central or South America, or different cities within the US such as Portland, Maine and Bend, Oregon. I still feel like I have more to learn at my current job and want to stick it out a little longer. Riding the startup wave is something I still want exposure to. This career experience, plus remote work flexibility with a steady income seems like the best option for me at this time. I also think that with some more travel experience under my belt, I’ll be in a better position to explore whether or not I want to take that gap year, and what I want to do with that time off. Maybe that looks like more travel, furthering my education, or perhaps even exploring that yoga teacher certification I’ve been contemplating. How do your finances impact this decision? In making a list of all the potential avenues I could take, I knew I needed to understand the financial requirements for each of these options. I sat down with Rebecca and we walked through the numbers to see how they might impact my choices. Here’s my current financial snapshot:

Savings: I have $11,000 in my high yield savings account today. With my monthly expenses around $3,000, this means I have a 3-4 month emergency fund saved up

Expenses: I continue to save about $1,400 a month.

Investments: I contribute a significant chunk to my 401k today, and on a go-forward basis, would like to contribute more to my individual brokerage account so I can continue to grow my investments. I’ve struggled to work out how much I should invest when I am considering moving or taking time off and might need more cash on hand.

I’ve worked pretty hard to get all my finances in order. In my gut, I know I am in a decent financial place to make a big life change, but do the numbers work? (Rebecca Here! Maddie has done such an amazing job of tracking her finances that this exercise was actually really easy to do. We just needed a clever way to apply the math to these big life choices. The below table helped us visualize where Maddie is on her journey. The goal here was to understand how much more time Maddie needs to work to be in a financially comfortable place to take time off or move locations.) Here were the scenarios we played out together:

I continue to work in NYC to save up enough money to take a sabbatical

The same scenario as above, but I up my monthly investments to my Roth IRA

I make the move to a lower cost of living country and work remotely

This last scenario would allow me to make a big life change today, while also having the benefit of lowering my expenses and enabling me to get to my goal faster.

We made some assumptions about what her cost of living might be like in Costa Rica – assuming things like her rent and groceries would go down in cost, but she’d likely have an uptick in travel and experiential costs. What we found is that moving to Costa Rica would shave off about 4 months of working to get to her target sabbatical fund – $25,000! How do you feel about the above math? How did this exercise help you? I’m excited. It makes it all feel so much more tangible and real. In my gut I always knew I could do something like this, but seeing the plan down on paper makes it feel so much more real. And it gives me more confidence to make such big life changes. Next steps for you? I’m gonna speak with my boss to ensure she is aware of my personal plan to relocate, and to also ensure that this will not impact my quality of work or engagement. (We’re rooting for you!) Any advice for other students? It’s ok to get lost in your plans. Get messy. Consider temporary living or travel. It could actually help you save more! I’m finding that if you’re paying to live somewhere expensive, or spending your discretionary income buying pricey drinks and meals, and all that is not making you happy, start considering other options. I bet you can find more ways to be fulfilled and save at the same time!!!

...

A huge thanks to Maddie for sharing her story with the Y&S community!

Boost your Wallet. Wellbeing. World.

Rebecca

Wanna take part in our student stories? We'd love to hear about you.

Disclaimer: The information contained in the Yield & Spread website, course materials and all other related content is provided for informational and educational purposes only. It is not intended to substitute for obtaining accounting, tax, or financial advice, and may not be suitable for every individual. Yield & Spread is not a registered investment, legal or tax advisor or a broker/dealer.